Years ago, I taught a course on the French Revolution. At the end of one class, an earnest student posed a question about something that clearly troubled her. Being Korean, she wondered what this ruckus in eighteenth-century France had to do with her. Why study it in such exhaustive detail? Was France really that important? And why should what happened there 225 years ago matter to a young woman from half a world away?

Because we live in an age that has undertaken the frenetic globalization of everything from menus to music, we can no longer take it for granted that upheavals such as the French Revolution are worthy of study because they form part of a shared Western political tradition. But without a shared tradition, can we talk about the past at all? What language is adequate to the task? And can the study of a singular event from a specific culture tell us anything about humanity in general?

Rebecca L. Spang rises to these challenges in her brilliant new book, Stuff and Money in the Time of the French Revolution. At first sight the subject might seem either overly narrow or overly broad, even arch. Stuff? What could that unscholarly colloquialism imply? And money? Might this be merely another dry monograph focused on the revolutionaries’ penchant for enlisting the printing press to pay for their ambitions and churning out bad paper, which eventually drove out good coin, leading to hyperinflation and undermining confidence in the new regime? No. Spang’s book is altogether more ambitious: What she proposes is nothing less than a new conceptualization of the revolution.

In recent decades, revolutionary historiography has been dominated by the idea of political culture. Historians like Roger Chartier, Keith Baker, François Furet, and Lynn Hunt stressed the cultural origins of revolution above the social and economic factors that had prevailed in previous accounts. More recently still, younger historians such as Michael Sonenscher and John Shovlin have blurred the distinction between cultural and socioeconomic explanations, arguing that commerce shaped culture and vice versa. They nevertheless continued to focus on the realm of discourse—the linguistic frames and mental habits that allegedly shaped political attitudes. Spang’s innovation is to shift attention from these higher-flown interpretive constructions to the basic notion of practice. What people thought, she reasons, came about as an inevitable response to what they did—or, more specifically, to the limitations placed on what they could do by the material medium through which they transacted business, i.e., money.

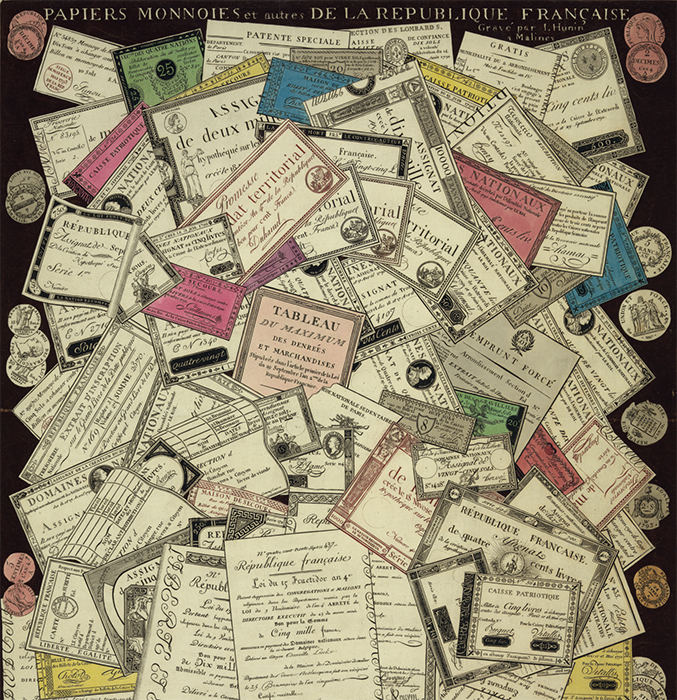

Money is worthless without trust. The person who gives up something useful in exchange for a token (whether coin or paper) trusts that others who possess what she wants will in turn give it up in exchange for the same token. Because a revolution disrupts existing networks of trust, revolutionaries seeking to replace the institutions they have toppled with stable institutions of their own also have to rebuild social trust. French revolutionaries therefore faced a dilemma. They were, of course, convinced that certain institutions of the ancien régime had to go. For example, the monarchy had long been in the habit of raising money by selling various government offices to private individuals, who thus became entitled to a share of the proceeds from their official duties. These “venal” offices, as they were called, also became quite lucrative property that could be bequeathed to offspring. But abolishing this inefficient and inequitable practice, so plainly incompatible with the dogma of equality, was no simple matter. The revolutionaries, many of them venal officeholders in their own right, had no wish to confiscate private property or despoil fellow citizens—or themselves—of important assets. Essentially conservative in their approach to such “stuff,” the people’s deputies therefore proposed to compensate those who had invested in the now-abolished offices with a new paper currency. These fiat notes were “backed” by land formerly owned by the Catholic Church; the leaders of the Revolution deemed the spoliation of the church just, so there was no trouble with the new cash system’s underlying ethics. France’s revolutionary government deemed these confiscated church lands “nationalized properties,” and the newly issued “assignats,” as the revolutionary paper was called, were said to be “mortgaged on” (hypothèque sur) or “assigned to” (assigné sur) these tangible and highly visible assets in land.

After all, the dominant school of eighteenth-century French economists, the Physiocrats, endorsed the notion that all wealth derives from land. That being the case, what could provide a more secure backing for a new currency than the splendid array of estates taken from the church and restored to the circuits of commerce? There was a certain sleight of hand involved in this maneuver: Although the assignat may have resembled an ordinary mortgage note, the property that served as its collateral could not actually be repossessed by the holder of the note if the borrower, in this case the government, somehow failed in its obligation. Put another way: Since the borrower was the sovereign state itself, the value of the note was in fact guaranteed not by land but by the state’s own seigniorage power—the same system of rather coercive social trust that had secured the value of the ancien régime’s metal coins. Indeed, to emphasize the continuity between the old, concrete money and the new, abstract money, the assignats initially featured a portrait of the king, who remained the reassuring symbol of ongoing state power until his execution in 1793.

As Spang ingeniously demonstrates, however, the desire to preserve private wealth while simultaneously abolishing or confiscating existing forms of private property involved the state in a tangled web of contradictions that no one foresaw at the outset. At first the assignats were issued only in large denominations. The thinking was that they would be used primarily for large transactions such as purchasing one of the national properties that backed the currency. But the paper inevitably entered circulation—and here the large-denomination bills posed a host of new problems. Merchants refused to make change, so in order to keep the assignats circulating, the government began issuing notes in smaller denominations. The sudden upsurge in these lower-value notes meant, in turn, that currency regulators couldn’t employ the labor-intensive anticounterfeiting devices used in the production of the larger notes, such as the use of actual hand signatures from federal officials and individually recorded serial numbers. Meanwhile, assignats themselves were devalued, since their large denominations tended to render them impractical for everyday transactions. Inevitably, this devaluation demolished social trust in the currency. Citizens of the revolutionary republic began to believe that assignats were in fact worthless. Once the revolutionary paper had largely lost the confidence of France’s own people, it was worthless in foreign transactions—a trend that accelerated, especially after France found itself at war with much of Europe.

With paper currency in crisis, ordinary French citizens continued to do business in metal coin, which was now in too scarce supply to meet the needs of the economy. Some deputies argued that it had to be that way, because “a written money” was of no use to “people who cannot read.” Thus “radicalization occurred as the ideal of national unity . . . came into sharp contrast with individuals’ daily experiences of buying, selling, and working.” This is the key insight: For Spang, the Revolution was not at first the radical remaking of a society that it ultimately would turn into. Rather, it became radicalized as the revolutionaries launched a process whose consequences they could not control.

Spang’s book is distinguished not only by its theoretical advances but also by fine writing and keen perception. Here, for instance, is how she characterizes the common practice of retiring the assignats by burning them: “Born, as it were, of land and living as water, the physical object that was an assignat would at the end of its circuit be consumed by flames.” She has a sure eye for the strangeness of the past, which enables her to furnish an abundance of arresting details. We learn, for example, of the significance of “the thirty heads of Geneva,” a reference to the thirty young women, many of them bankers’ daughters, who formed the actuarial basis of life annuities that were a popular investment vehicle in their day. These instruments, weirdly enough, were a forerunner of the “derivative securities” that modern financial engineers have created to decrease risk by spreading it among presumably uncorrelated random variables—in this case the life expectancies of a sample of young Genevans. We also learn about the techniques of minting, printing, and engraving currencies, and about the people who performed these highly specialized tasks.

Still, Spang’s greatest contribution is her theoretical reorientation of revolutionary studies from causes to practices, from precursors to processes. She has provided historians—and not just those of France or the French Revolution—with a new set of lenses with which to view the past. In the process, she has vindicated the study of history and provided an answer to the question posed by my student many years ago: We study history because, in the hands of a gifted historian like Rebecca Spang, it reveals the true nature of the human predicament.

Arthur Goldhammer is a senior affiliate of the Center for European Studies at Harvard University. He writes widely on French history, culture, and politics and has translated many French works into English, most recently Thomas Piketty’s Capital in the Twenty-First Century (Harvard University Press, 2014).